FinWhaleX – Bringing Together Private Investors and Borrowers

PRESENTATION

Cryptocurrency, which is sometimes referred to as digital currencies operate independently of any central authority or banks and it is permissionless to use, the transaction is open & available for people to see.

Because it is decentralized, government authorities such as the Judiciary, Authorities in-charge of taxation, and the central banks do not find it appealing because it cannot be taxed and they don’t have power to influence the transactions of traders/participants.

Peer-to-peer (P2P) computing or networking is a distributed application architecture that partitions tasks or workloads between peers. Peers are equally privileged, equipotent participants in the application. They are said to form a peer-to-peer network of nodes.

Blockchain technology is a structure that stores transactional records, also known as the block, of the public in several databases, known as the “chain”, in a network connected through peer-to-peer nodes. Typically, this storage is referred to as a ‘digital ledger’.

Every transaction in this ledger is authorized by the digital signature of the owner, which authenticates the transaction and safeguards it from tampering. Hence, the information the digital ledger contains is highly secure.

Synopsis of FinWhaleX

FinWhaleX is a P2P lending platform that provides access to credit in any place and at any time on the basis of blockchain technologies, machine learning and Big Data.

It can also be referred to as the world’s first P2P credit platform, Zopa, was launched in 2005 in the UK, and since then, P2P platforms have achieved extraordinary growth and have become a vast global industry. This is not surprising, since it is able to provide 2 billions access to credit throughout the world.

However, no region in the world even came close to such an explosive and unprecedented growth in P2P lending, which was noted in the world’s second largest economy: China.

In 2007, China first released the P2P platform, and by 2013, that number had soared to 800. By May 2018, 6,142 platforms were operating in China.

In 2016, over 3.4 millions investors were registered on China’s P2P platforms, while the increase in the amount of capital involved in P2P lending increased from 21 billions Yuan (3 billions US dollars) in 2012 to 1,411 billions Yuan (216 billions US dollars) in 2016.

Growth of P2P platforms in the West: in 2016 in the UK there were only 9 authorized companies offering crowdfunding platforms based on loans, in the European Union there were 24 platforms with a volume of 3.2 billions Euros, and in the USA – 25 with a volume of 29 billions dollars. According to Dr. Chuanman You, a FinTech expert based at Tel Aviv University, loans emerged in the Oxford Capital Markets Law Journal report on the recent development of FinTech regulation in China.

China’s phenomenal growth in the P2P lending industry is due to both insufficient financing of small and medium-sized enterprises (SMEs) and low-income households by traditional banking institutions, and, on the other hand, high return on P2P investments. According to Dr. You, the lending industry has attracted capital like private and institutional investors.

While financial constraints for SMEs and low-income households are a global problem, the problem is exacerbated by the dominant economic structure of China’s state-owned enterprises combined with repressive financial policies.

In 2016, almost 50% of Chinese P2P platforms were problematic, often fraud, flight of funds, and illegal fundraising were reported. By May 2018, about 2058 platforms encountered liquidity problems or other more serious problems.

China’s initial lack of a comprehensive regulatory regime has contributed to the phenomenal growth of P2P platforms, but it also generated huge market risks that could jeopardize the sustainable development of the industry.

How FinWhaleX Works?

FinWhaleX is a P2P credit lending platform that provides access to loans anywhere and anytime. Let’s take a look at how this works. In order to apply for a loan, the borrower must first set the parameters for the loan. These include the amount, interest rate, loan term, etc. Sometimes the company recommends evaluating the parameters of other applications in order to more easily navigate the process and select the most advantageous offers.

In addition, there are options for choosing an application for a loan on bail. Two ways can be offered for this. First, you can place an application for secured lending. This method is more attractive. Second, you can transfer the required amount of collateral after the lender accepts the application. The commission for filing a loan application is 0.5% of the amount depending on the loan term.

You Place a Loan Application

When creating your loan application, the Borrower set the parameters at its choice (amount, interest rate, period, etc.). We recommend evaluating the parameters of other applications already placed on FinWhaleX – lenders choose the most profitable applications for themselves. You can choose when to secure a loan application with collateral. There are two available ways. On the one hand, you can place the collateralized loan application which is more attractive for creditors. On the other hand, you can transfer the necessary amount of the collateral after the lender accepts your application. When placing the loan application, you need to pay a transaction fee in amount of 0.5% of the loan amount depending on the loan period.

Lender Accepts Your Loan Application

All creditors guarantee to fulfill their obligations for the accepted applications. After the lender accepts the application, FinWhaleX will generate a special multisig-address where your collateral (bitcoins) will be stored until the end of the loan period. Each party owns only one Private key for the multisig-address. Multisignature (multisig) refers to requiring more than one Private key to authorize a Bitcoin transaction. It guarantees that no one is able to access the collateral owning just one Private key.

You Return The Money Within The Term of The Loan

After repayment of the loan, you automatically return the deposit to yourself. No one can use your bitcoins until the loan is repaid – they are frozen in a special wallet. You can not return the loan, if it is not profitable for you. If the rate of bitcoin has not risen or fell, then you can refuse to repay the loan. In this case, the collateral simply goes to the lender, and your loan obligations are repaid.

TOKEN DETAILS

Token name: FinWhaleX

Symbol: FWX

Type: ERC20

Platform: Ethereum

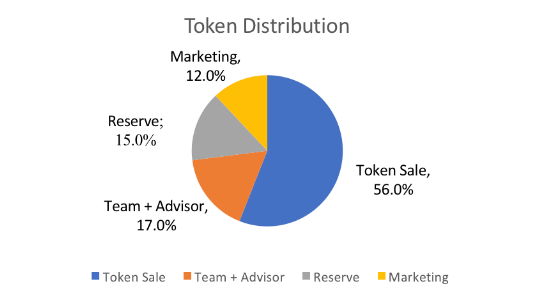

DISTRIBUTION OF TOKENS

Price: 0.00000001BTC

Seed round: 11,700,000,000 FWX

Private round: 45,500,000,000 FWX

Public round: 15,600,000,000 FWX

Token sale: 72,800,000,000 FWX

Team + Advisor: 22,100,000,000 FWX

Reserve: 19,500,000,000 FWX

Marketing:15,600,000,000 FWX

THE TEAM

Vladimir Egorov

CO-FOUNDER CEO

18 years in leadership positions. In 5 years the financial sector in the field of loans and investments. From the management of micro financial services company to build from scratch a network of online pawn shops.

Artur Vartanyan

CO-FOUNDER COO

More than 14 years in the of information technology. Development and implementation of the first public services in the Russia. Automation of a large number of Telecom and financial companies in their industries.

Aldar Sandanov

CO-FOUNDER COO

From 2008 to 2016, he headed the IT Department at Promregionbank. He was responsible for the current operations of all Bank’s information systems, involved in creating the IT development and security strategy.

Viktor Egorov

CFO

Over 13 years of experience in leadership positions. 10 years in sales, 3 years in the financial sector in the field of loans and investments. Achievement of leading positions at the head of departments.

Paddy Tan

CSO

Founder at InterVentures Asia. He is armed with vast experience in identifying startups from an idea to mentoring, funding and acquisition stage.

Glen Liu

BUSINESS DEVELOPMENT (SEA)

CEO at BlackBox labs. Glen engages clients on multiple strategic levels, providing them with network access and digital solutions required to deploy and commercialize businesses.

Andrei Ivanov

BUSINESS DEVELOPER

Over 14 years of experience in leadership positions. Development Planning and Optimization of the company’s expenses. The increase in sales of related services. The interaction of government agencies. Achieving high levels in the market of his companies from scratch.

Sergey Sevantsyan

CIO

He regularly serves as a keynote speaker at international events. Investment Relations Manager at KryptoPal. Scorer and analyst of the ICO project in Neironix. Market Research Manager at ENVIENTA. International Investment Relations Manager at DEEX exchange.

Anastasia Leina

HEAD OF PR/IR

In advertising for more than 10 years: from the designer of the printing and fashion industry to the financial sector. Advertising Department of the financial organization for 5 years.

Kirill Kvan

PROJECT MANAGER

Over six years of experience in Internet marketing. He has an excellent track record, including over 100 successful advertising campaigns for ForteBank, Tutti Frutti Frozen Yogurt, GoodProject.kz, and many other companies.

Mikhail Vinertsev

FULL-STACK DEVELOPER

From 2011 to 2016, he worked at Promregionbank. He started as an IT department specialist and later was promoted to the Head of the IT Department. 5 years of experience in blockchain development.

Alexey Pronin

FULL-STACK DEVELOPER

In 2014, he joined Synthesis of Intelligent Systems as a front-end developer. He is fluent in a number of languages such as HTML, C#, PHP, JavaScript, and NodeJS.

Aleksandr Bragin

FULL-STACK DEVELOPER

He graduated from the Institute of Energy (Tomsk Polytechnic University) with a degree in Electrical Power Engineering and Electrical Engineering. From 2014, he worked as an front-end developer for the R70 Web Studio..

Igor Sakovich

ANDROID/IOS DEVELOPER

Extensive experience developing mobile applications for Android / iOS, as well as more than a year of experience with Flutter. He is fluent in programming languages Java, Kotlin, Swift, Objective-C, Dart.

Aleksey Afonin

UI/UX DESIGNER

The main directions in the projects are corporate portals, web aggregators, financial dashboards, monitoring analytical systems.

ROADMAP AND DEVELOPMENT PLAN

09.2018

The emergence of an idea about p2p lending based on blockchain technology, smart contracts

11.2018

Market and competitive environment

analysis 01.2019 Concept

development, platform architecture FinWhaleX

03.2019

Platform prototype implementation

04.2019

Private round of financing, demonstration of the platform concept and prototype.

Hiring a development team to implement the product.

05.2019

Presentation of the platform at the conference Russian Tech Week-2019.

Start of development of the platform:

smart contracts / crypto-wallets

web interface / backend.

Mobile application

06.2019

Launch of the beta version of the platform.

07.2019

Launch of the platform with the functionality of issuing loans secured by BTC and ETH, verification of user documents, referral system.

08.2019

Launch of Liquidity Provider functionality to provide liquidity for cryptocurrency exchange traders. IEO FinWhaleX.

09.2019

The first release of the mobile application for the Android / iOS platform.

11.2019

Obtaining financial licenses for working with fiat currencies.

Launch FWX Scoring technology.

12.2019

Adding to the platform of a new type of collateral – tokens Ethereum ERC-20

01.2020

Adding a new type of collateral platform – tokens EOS

02.2020

Adding a new type of collateral platform – tokens Tron TRC-20

03.2020

Listing token FWX 5 kriptobirzhah

04.2020

Adding to the platform A new type of collateral – digital assets Steam Market (TF2, Dota 2, CS: GO)

05.2020

Getting the platform started to work with pawnshops.

The release of a mobile application with the support of a new type of collateral.

06.2020

Start of operation of the platform with fiat currency.

The release of a mobile application with support for working with pawnshops.

08.2020

Run the issuance of loans without collateral.

Mobile application release with support for fiat currency.

10.2020

Release of a mobile application with support for issuing loans without collateral.

12.2020

Launch of products based on Big Data.

FOR MORE INFORMATION:

Website: https://finwhalex.com/

WhitePaper: https://docs.google.com/document/d/1XhjDhhnjHJnTmgHlIzDlwECd4nV5zsPwJEmGZxdqjJ0/edit?usp=sharing

Twitter: https://twitter.com/FinWhaleX/

Facebook: https://www.facebook.com/FinWhaleX/

Instagram: https://www.instagram.com/finwhalex/

Telegram chat: https://t.me/finwhalex

PUBLISHER

BTT USERNAME: bayo88

Comments

Post a Comment