Vena Network – The Open Protocol for Tokenized Asset Financing and Exchange

Asset financing is a form of credit where the financial institution extends a loan to a borrower based on the fixed asset investments which is used as security for the advanced loan. Asset financing provides some form of capital for organizations to expand their businesses and grow. The level of competition in these markets has intensified as bank seeks to increase their market share. Asset finance mostly comprises of an agreed percentage of total asset cost with remaining repayments done by Instalments which factor in the capital value and accrued interest rates. In many cases, ownership passes from the bank to the other parties after the final Instalment is settled.

VIDEO PRESENTATION ON VENA NETWORK

ABOUT VENA NETWORK & HOW IT WORKS

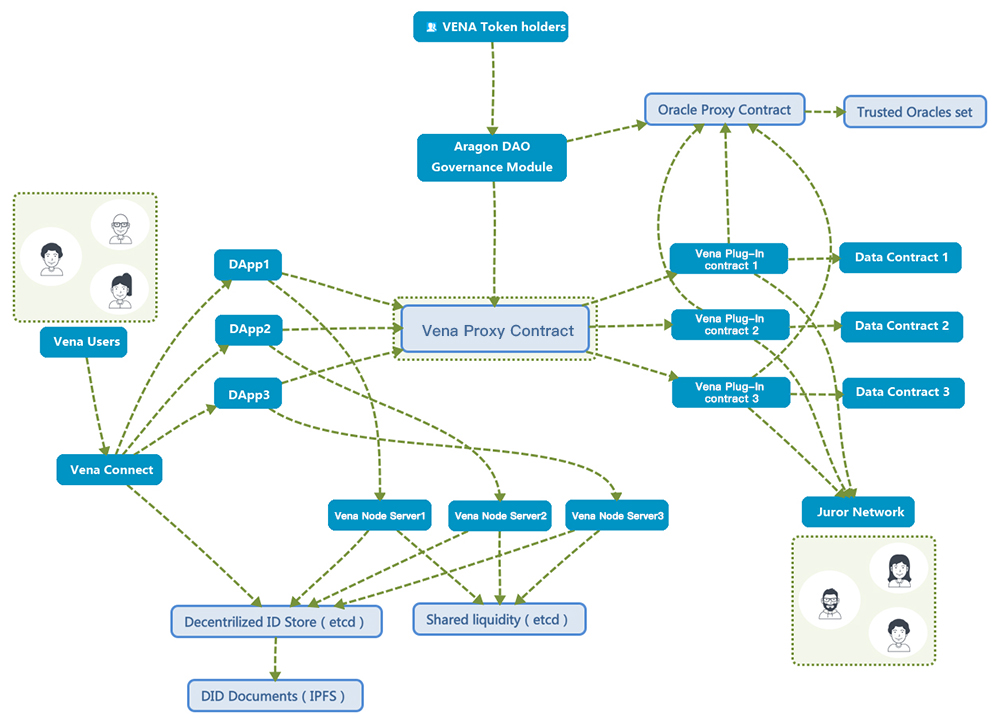

Vena network seeks to create a non-centralised digital asset market and exchange enterprise via the Vena protocol, which has two major categories:The basic protocol layer which includes registration, configuration, routing, and management of upper layer financial assets AND Asset protocol layer: This is based on assets, completes user-defined financial businesses through the implementation of the terms contract interfaces.

The key element of Vena network is Luoshu button that allows users to perform open deal for property and tokens via rocket deal. Their network allows users to perform peer to peer decentralized transactions around the globe at any time they want to. And when it comes to area, all of the digital assets of the individual are stored straight in their contract if not misused or locked in a streetwise contract when there is an concord. A new block chain project, Vena Meshwork, aims to alter the debt markets, thereby applying the benefits of block chain application to the most spectacular function in the financial sector.The key success behind ICOs has been that they enable p2p cap nurture. Rather than the grouping having to go through VC finances that endure squeaky fees, fill were healthy to fit without having to go finished a representative. Vena Mesh intends to wage a kindred goodness in the debt markets by removing the impoverishment for middlemen in the disposal transform.

Vena Protocol Ecosystem

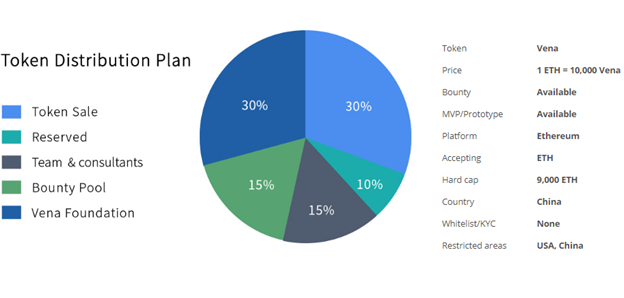

The total supply of the coin is fixed at 1 billion which will be distributed as follows:

Bounty pool: 15%

Vena foundation: 30%

CONCLUSION

Vena will implement a system where all transactions are executed by the smart contract, and are free from human manipulation, thereby kicking against fraud. Transactions carried out on the Vena network are usually cost effective, efficient and free of incredulous financial mediators.

NOTE: This article is just a guide to prospective clients, investors and every person scorching for a slice of this amazing project,

You can get more information about these project with huge potential by following the link below:

Whitepaper: http://whitepaper-en.vena.network/#51-the-overall-architecture-of-vena-network

Telegram: https://t.me/vena_network

Twitter: https://twitter.com/VenaProtocol

Facebook: https://www.facebook.com/Vena-Network-207271413455484/

Medium: https://medium.com/@457597870

Github : https://github.com/venanetwork

PUBLISHER

bayo88

BITCOINTALK PROFILE: https://bitcointalk.org/index.php?action=profile;u=2407711

Comments

Post a Comment