AFRICUNIA - A 100% Fully Digital Crowdfunded Open Bank Based on The Blockchain Technology 3.0

INTRODUCTION

Since the emergence of blockchain technology in 2008 when Satoshi Nakamoto introduced bitcoin, there have been rigorous efforts to apply the blockchain to several aspects of the global business process, Blockchain technology has been described as having the potential to disrupt many industries with a low-cost transaction, immutability, and enhanced security. In the years that have followed, many other blockchain implementations have been developed with each one exhibiting unique features tailored to specific use-cases.

Blockchain has made it possible to issue just about any asset via a distributed ledger framework. With the aid of cryptocurrency tokens, these assets can be given economic value in order to initiate and validate several transactional processes. Several on-chain protocols have been developed by a number of startups and established companies alike in order to create blockchain-based solutions.

As more technological advancements are uncovered,AFRICUNIA a platform that offers banking services using the Blockchain technology knows the challenges of the economy and it is bringing a new kind of bank which operates on the digital currency based on the blockchain technology. They are trying to bridge the gap between the traditional banking and the digital currency. Creating solutions for the banks to invest in the right cryptocurrency is one of the core missions of the platform.

ADVANTAGES OF BLOCKCHAIN IMPLEMENTATION

Decentralized Payment Processing

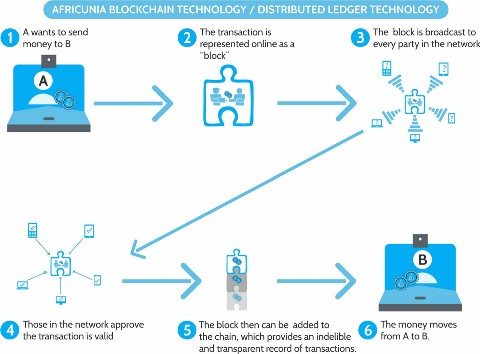

The payment processing framework for global commerce is based on a centralized system which requires the services of third-party authenticators. These third-party agents are responsible for ensuring the fidelity of the global payments system and they charge fees for their services. One of the fundamental philosophies behind the operation of the blockchain is the removal of these third-party agents and their associated cost of trust and replacing them with a robust, functioning distributed ledger payment framework.

Creating an Immutable System of Record

The blockchain is the first successful implementation of the distributed ledger framework. On public blockchains, the distributed ledger constitutes an immutable system of records that is available to all participants. The immutability of a blockchain ensures that it is tamper-proof.

Reducing Cost of Transaction

Payment processing remains the basic level of commerce but it is one that has not seen much in the way of evolution since the emergence of fintech protocols. Blockchain technology has the potential to disrupt commerce by causing a paradigm shift in the mechanism by which transactions are carried out. The fees charged by third-party actors and middlemen in the payment chain constitute a considerable portion of the cost of transactions. By eliminating the middlemen, the cost of transaction is materially diminished.

Enhanced Security

Operating on a multinational scale opens up any enterprise to the activities of hackers looking to breach the structural and functional integrity of the platform. Blockchain technology offers a robust security framework that makes it difficult for hackers to make an incursion into the platform. There is no central point of failure and hence no single point of entry for malicious digital attacks. This ensures the safety and security of the data collected by field agents and the payment processing network. that provides an accurate accounting for the entire platform.

ABOUT AFRICUNIA

AFRICUNIA Blockchain Digital Bank would be a new and unique Financial Institution that would offer not only traditional banking services related to opening of savings & current accounts, issuing of debit & credit cards, loans and forex exchange services but also will provide innovative banking services such as bank-to-bank transactions, interconnecting the world of traditional finance and cryptocurrency startups.

OBJECTIVE OF AFRICUNIA

The main objective of this project is to develop a new standard for tokenized investment that will act as a catalyst of bridging the gap between the fiat and cryptocurrencies. It will be the 1st African Crowdfunded Open Bank and it would have its own digital currency called AFCASH which is open for purchase during the Initial Coin Offering (ICO). The AFRICUNIA BANK project is going to be a 100% fully Digital Bank – a digital bank based on the concept of Decentralised Ledger Technology – Blockchain. The new and unique Financial Institution is going to offer not only traditional bank services such as opening of savings & current accounts, issuing of debit & credit cards, loans/lending, exchange but also would interconnect the world of traditional finance and cryptocurrency Startups.

The AFRICUNIA Technologies

To live inside the constraints of Traditional Banking, they will make probably essentially the foremost of API (Authorized Payment Institutions) hence employing the proper criteria of innovation and services.

The foundation of AFRICUNIA BANK is capital spent increasing has been adjusted to the purchase increase in turn maximizing revenue return.

Additionally, so a lot as the technology safety is involved our network layout is decentralized. Thus, instruments attach information garage safety and encryption mechanism of folks or businesses.

Processing of Information is Automatic by a technique of utilized AI algorithms.

Blockchain Technology will revolutionize the situation that is digital. It has the capability to interrupt businesses, but particularly the banking industry, and create processes secure more democratic and productive. There’s a challenge and people expect payment processing in real time, although in this era all payments have been made. Transferring funds is not just about transferring funds out of one from lender to another or from A to B. To guarantee satisfaction of receiver and sender, payment needs to be validated through an intermediary such a Correspondent Banks or Central Banks which suggests settlement can take rather a long time, oftentimes about two or more times for national obligations and 3 to 5 business days for global payments.

AFRICUNIA is inside the activity of executing AFCASH — a crypto — predicated on AFRICUNIA Protocol Consensus Algorithm (APCA) to shield the contemporary troubles of correctness, consensus, and usefulness the show protocols have partially solved. Again, the aim is to create a benchmark for investment that can work as a catalyst of bridging the hole among cryptocurrencies and the fiat.

Token Details

Token Symbol: AFCASH

Token Supply: 1,000,000,000 AFCASH

Total ICO Supply: 500,000,000

Circulating Supply: 1,000,000,000 AFCASH

Token Price: 1 AFCASH = $0.10 USD

Unsold Token: All UNSOLD TOKENS have been underwritten by MAINSAIL TRADING LTD (DUBAI) and IBB INTERNATIONAL HOLDINGS LIMITED (MALAYSIA) and would be taken over by the Financial Group.

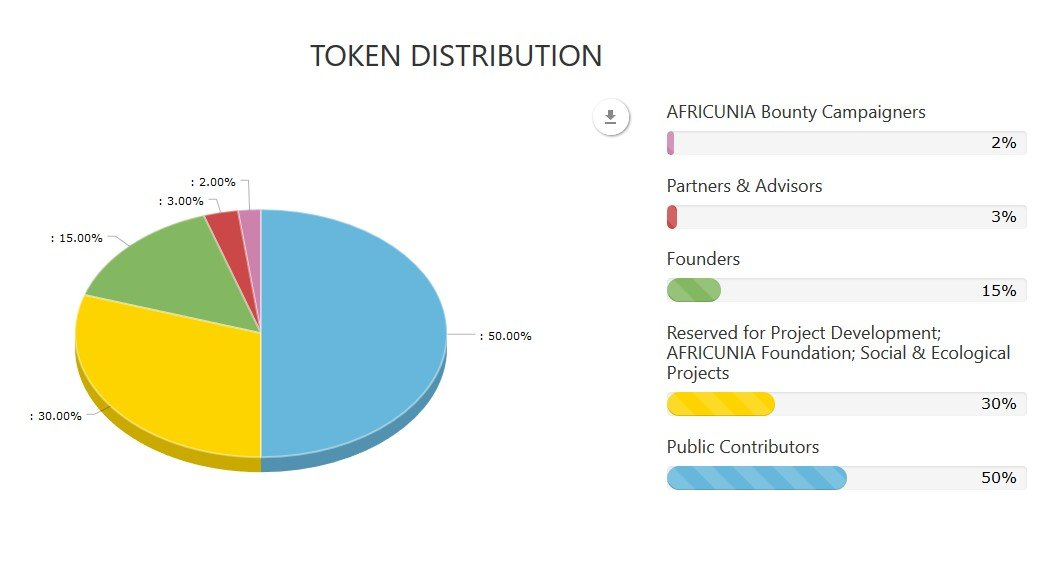

Token Distribution

“THE FUND STRUCTURE

Definitely the fund structure will keep changing depending on the opinion made by legal our counsels. However, at this time 50% of AFCASH will be allocated to public contributors, 30% will remain the Company and Foundation reserve for projects development and for funding Social & Ecological projects. Fifteen percent (15%) will be reserved for Founding Members, 3% for the Advisors and Partners while the remaining 2% will be channeled towards distributions to our Bounty Campaigners.

THE SHARING REVENUE

At the end each Financial Year, 20% of AFRICUNIA BANK’s Profit will be distributed among all Holders of our Token (AFCASH) based on each Holder’s Share of total amount of Tokens issued, and this will be automatically paid out to our Coin Users in their respective Wallets. In other words, you are entitled to AFRICUNIA BANK’s revenue. Consider this as a PASSIVE INCOME.” – This quote was gotten from the Africunia Website – https://africunia.com

ROADMAP – From the Africunia Whitepaper – https://africunia.com/wp-content/uploads/2018/02/AFCASH-Whitepaper.pdf

Milestone 1: 10th July 2017 to 1st January 2018

RESEARCH AND EXPERIMENT

Researching and experimenting with the APCA will be our first step in the Africunia journey. Our developers will develop dummy prototype of Blockchain system based on APCA and test it for correctness, consensus, and utility. We are already researching and experimenting with the APCA and its application in Blockchain. This phase will run up to 1st January 2018.

Milestone 2: 1st December 2017 to 31st December 2017

PRE-ICO

The AFCASH pre-order will open on 1st December 2017 and run for 4weeks up to 31st December 2017. We are targeting a yearly supply of 1 Billion AFCASH tokens but ICO circulating supply of 500 Million AFCASH.

Milestone 3: 1st January 2018 to 31st May 2018

ICO

The AFCASH ICO will start on 1st January 2018 and run for 5 months up to 31st May 2018.

Milestone 4: 1st July 2018 to 31st July 2018

DEVELOPMENT OF BLOCKCHAIN PROTOTYPES

At this stage, we will develop a Blockchain prototype that will help to eliminate ambiguities and enhance accuracy with our AFCASH crypto. We expect this step to take 4 weeks and will run from 1st March 2018 to 31st March 2018.

Milestone 5: 1st August 2018 to 30th September 2018

DEVELOPMENT OF THE BLOCKCHAIN BETA VERSION

A beta version of our AFCASH cryptocurrency will be developed to help developers understand the ecosystem better as further ambiguities are eliminated. We expect this phase to take a maximum of 8weeks.

Milestone 6: 1st October 2018 to 31st October 2018

TESTING OF THE ECOSYSTEM

We will test the system as a whole and ensure it is working properly and is interoperable with existing systems. This stage will take a maximum of 4weeks and will run from 1st October 2018 to 31st October 2018.

Milestone 7: 1st November 2018 to 30th November 2018

COMPLETE DEVELOPMENT OF OUR BLOCKCHAIN TECHNOLOGY

We expect the complete Blockchain Technology to be finished by 30th November 2018.

Milestone 8: 1st December 2018.

LAUNCH OF THE BLOCKCHAIN AND ECOSYSTEM

We hope to launch the Blockchain Ecosystem on 1st December 2018.

Milestone 9: December 2018

SOLIDIFICATION AND EXPANSION OF THE TECHNOLOGY

After the launch on December 1, the project will undergo continuous maintenance and development to address all IoT, Machine Learning and big data concerns.

AFRICUNIA BANKING ROADMAP

Milestone one: $2 Million

AUTHORIZED FINANCIAL PAYMENT SERVICES

Diverse Payment Services

Acquiring SWIFT Membership

Obtaining API License

EBA Clearing & Payment Systems (EURO1, STEP1, STEP2, MyBank)

Person to Person Payments & Loans

Investment Portfolios

European Payments Council RuleBooks and SDD Collection

Milestone two: $3 Million

eMONEY SERVICES

EMI License

Foreign Exchange (FX)

Capital loans for consumers

Acquiring Payments and Card Issuance

Milestone 3: $6 Million

COMMERCIAL BANK

Bank License

Crypto-based Point of Sale (PoS)

Debit Cards

Credit Cards

Current Accounts

Savings Deposits

Open API Applications

Card Memberships

Milestone four: $10 Million

DIGITAL PASS TECHNOLOGY

Hybrid Blockchain Technology (Browser-based Prove of Work & Prove of Stake)

Offline/Online/Ultra Thin Smart High Security Wallets

AML / KYC Protocols

Big Data Technology

Applied AI

Internet of Things (IoT) Technology

eSignatures

eSeals

Milestone five: $25 Million to $50 Million

SMALL AND MEDIUM SIZED ENTERPRISE FINANCIAL MARKETPLACES

Insurance & Brokerage Services

CrowdFunding

Venture Capital Funding in BioTechnology & ICT

Private Equity Funding

Small Business Funding and Loan Matching Services

Fiat FX & Cryptocurrency Exchange/Trading

Milestone six: $50 Million to $100 Million

CROWDFUNDING/VENTURE CAPITAL FUNDING/INSURANCE & BROKERAGE SERVICES

If we are able to realize funds above $50 Million we will use same to capitalize on Venture Capital investments and SMEs funding as well as investment on Insurance and Brokerage services.

MEET THE AMAZING TEAM

Don Chancellor – Founder & President (CEO)

Madeleine G. Winkler – Company Secretary

Dieter Frank Wipf – Business Development Director

Irina Yuhanyuk(M.Sc., Int‘l Economist) – Marketing Director

Gérald Tissière – Chief Technology Officer (CTO)

Alexander Papievis – Assistant CTO

Adedapo Ajayi – Assistant CTO

Christian Bogdan – Blockchain Developer

Usman Farooq – Graphic Designer

Panda O. Oku – Head of Operations

Claudius Lyn – Project Manager

Nur Ilham – Bounty Manager

Oksana Sokolovska – Assistant, Marketing Director

Sina Ickler – Coordinator, Languages & Translations

Vasil Pavlovich – Financial Advisor

Nesto Boccovi – Financial Advisor

Gregor Novak – Technological Advisor

Karl Hartmann – Technological Advisor

Barrister M.O Nlemedim – Attorney/Legal Advisor

Attorney PGDip LP Cal Evans – Legal Advisor

Barrister Kester Elebesunu – Legal Advisor

Barrister Kevin Koo – Legal Advisor

Barr. Vlad Andriushchenko – Legal Advisor

Dr. Sambhaji Kokitkar – AFRICUNIA Rep, India

Engr. Isaac Elusanmi – AFRICUNIA Rep, Lagos, Nigeria

Chima Ogoko – AFRICUNIA Rep, Abuja, Nigeria

Reggie Garcia – Sales Manager

NOTE: This article is just a guide to prospective clients, investors and every person scorching for a slice of this amazing project,

You can get more information about these project with huge potential by following the link below:

Website: https://africunia.com/

ANN Thread: https://bitcointalk.org/index.php?topic=2847593

Facebook: https://www.facebook.com/africunia/

Twitter: https://twitter.com/africunia/

Telegram : http://t.me/africunia

PUBLISHER

bayo88

BITCOINTALK PROFILE: https://bitcointalk.org/index.php?action=profile;u=2407711

Comments

Post a Comment